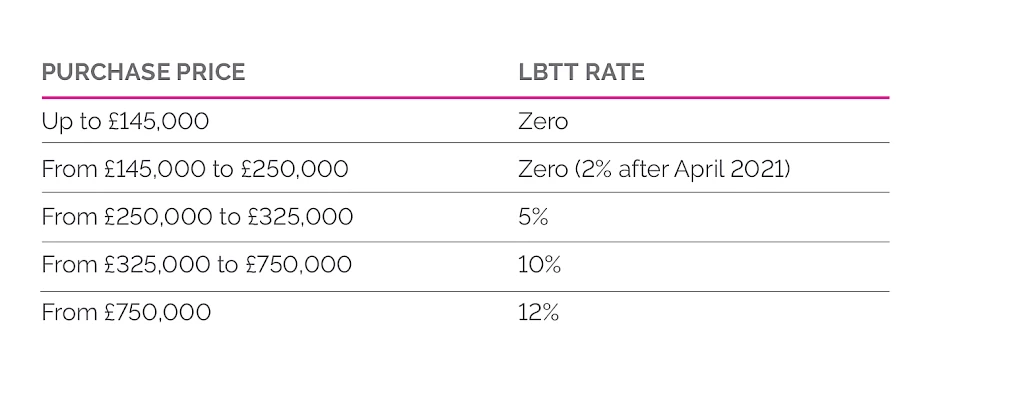

On 15th July 2020, the Scottish Government announced changes to the Land and Buildings Transaction Tax (LBTT). These changes could save you up to £2,100 if you buy a new home before 31st March 2021 - making this a great time to buy.

The changes mean you won’t pay any LBTT on homes priced up to £250,000. If you are buying a home worth more than £250,000, you will still need to pay LBTT, but you will pay £2,100 less than before the changes took place.

If you are interested in purchasing a new Dundas home, we have detailed below the savings:

To calculate exactly how the changes will benefit you, go to: https://www.revenue.scot/land-buildings-transaction-tax/tax-calculator/lbtt-property-transactions-calculator

For more information, please get in touch with one of our sales teams. They’ll be happy to talk you through how this new legislation will affect you.